Article | Five steps to HOTMA success | 2 | Verification Methods

Sep 11, 2025

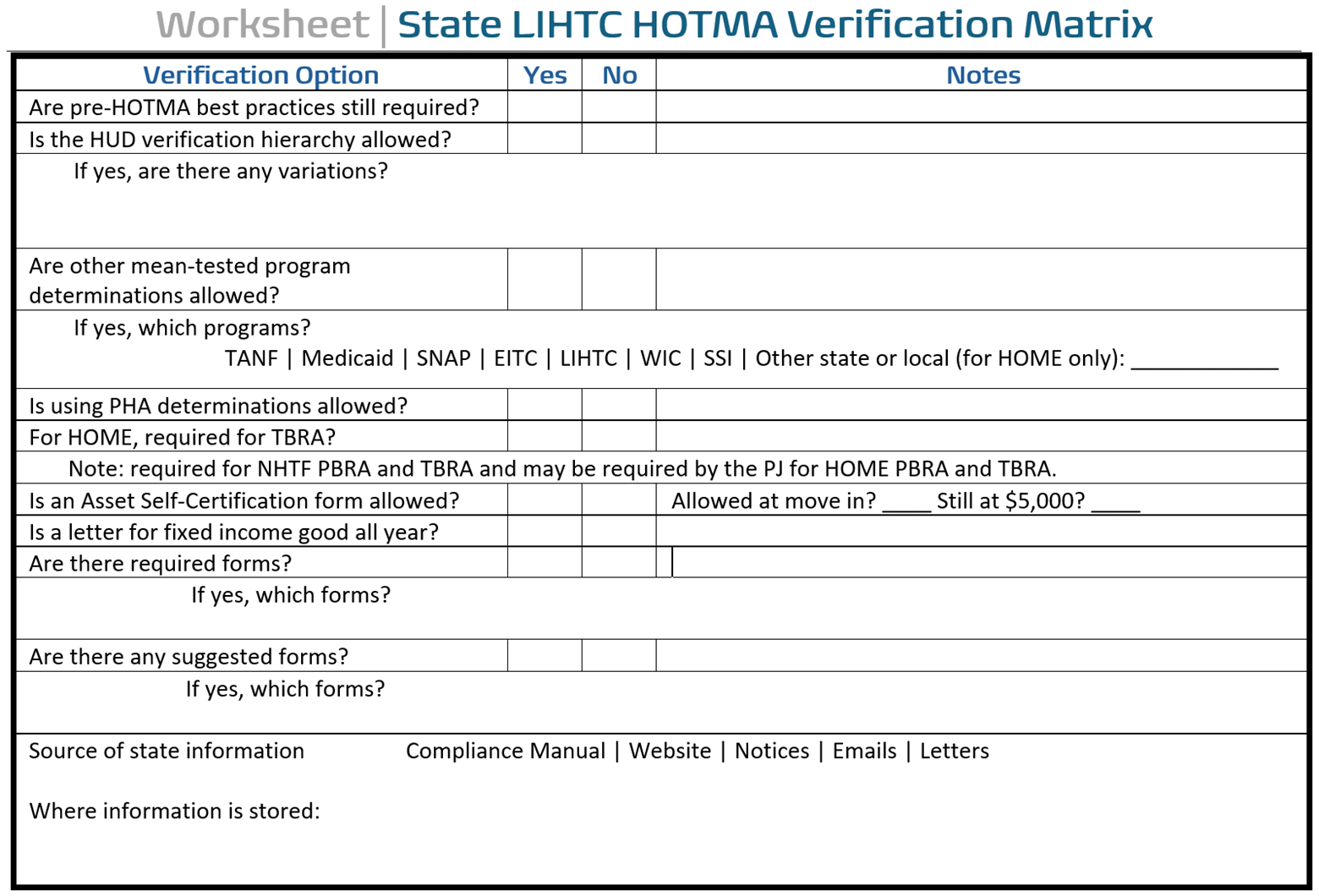

Note | Charts in this article series are from the HOTMA Audit Toolkit received by attendees of the 2024 and 2025 Costello Compliance Summit.

Step 2 | Adapt verification rules

HOTMA introduced a new hierarchy of how income, assets, and other key factors are verified. Priority is given to third-party documents provided by the household, rather than those exchanged directly with the third party. HUD also updated its process, now requiring a minimum of two recent consecutive pay stubs to calculate annual employment income, and only one current checking account statement for verification to establish the current balance that is now used.

Borrowing from the LIHTC code, HOTMA also allows self-certification of assets. Additionally, it instituted a new imputed income threshold from $5,000 to $50,000. As this was the threshold the IRS used in establishing the LIHTC self-certification threshold, this shifted the $5,000 to $50,000 for self-certification for the LIHTC program as well.

HOTMA and the HOME 2025 Final Rule also expanded on the existing LIHTC rule that allows Public Housing Authority (PHA) to verify income for recipients of Housing Choice Voucher assistance. This concept is expanded as an option to other means-tested federal programs, including all other HUD programs, TANF, WIC, and the LIHTC, among others. A HOME agency may also add other local or state assistance programs under HOME 2025. If these other highly regulated federal programs (or state or local for HOME) have verified and determined income in the last 12 months, the determination is allowable for HOTMA and HOME purposes. PHA verification is a firm allowance in LIHTC and HOME code, but the expansion to other means-tested programs varies among LIHTC and HOME agencies.

Examples

- Texas and Wyoming. TDHCA and WCDA adopted the HOTMA hierarchy as written by HUD. They do not, however, allow the use of other means-tested programs.

- Indiana and Arizona. IHCDA and ADOH adopted the HOTMA hierarchy as written by HUD. They also allow the use of other means-tested programs.

- California. CTCAC did not adopt the HOTMA hierarchy. Verification of employment, three months of pay stubs, YTD, and other calculations beyond HUD requirements are still necessary before a household qualifies. It does not allow the use of other means-tested programs.

Note | These examples reflect the author’s understanding based on written statements and training provided by the state. The individual states must be consulted to confirm accuracy and for further details.

What verification rules will the agency implement?

- LIHTC: Is the agency adopting the HOTMA hierarchy?

- HOME will continue to use source documents covering 2 months as required by existing HOME regulations.

- LIHTC: If the hierarchy is allowable, is it as written in HUD guidance or with some adjustments? *

- HOME will continue to use source documents covering 2 months as required by existing HOME regulations.

- LIHTC and HOME: Is the agency allowing the use of other means-tested programs to verify income?

- If allowed for HOME, the other program determination is used and replaces the 2 months of source documents usually required by HOME.

* If there are adjustments to the hierarchy, per question 2, the following worksheet may be helpful.

Up next: Step 3| Develop a system to implement annual adjustment factors

Advertisement

Hybrid event - online seats may still be available!

Click on image below for more information

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.