Article | HOTMA Highlights | Imputed Asset Income

Oct 18, 2023

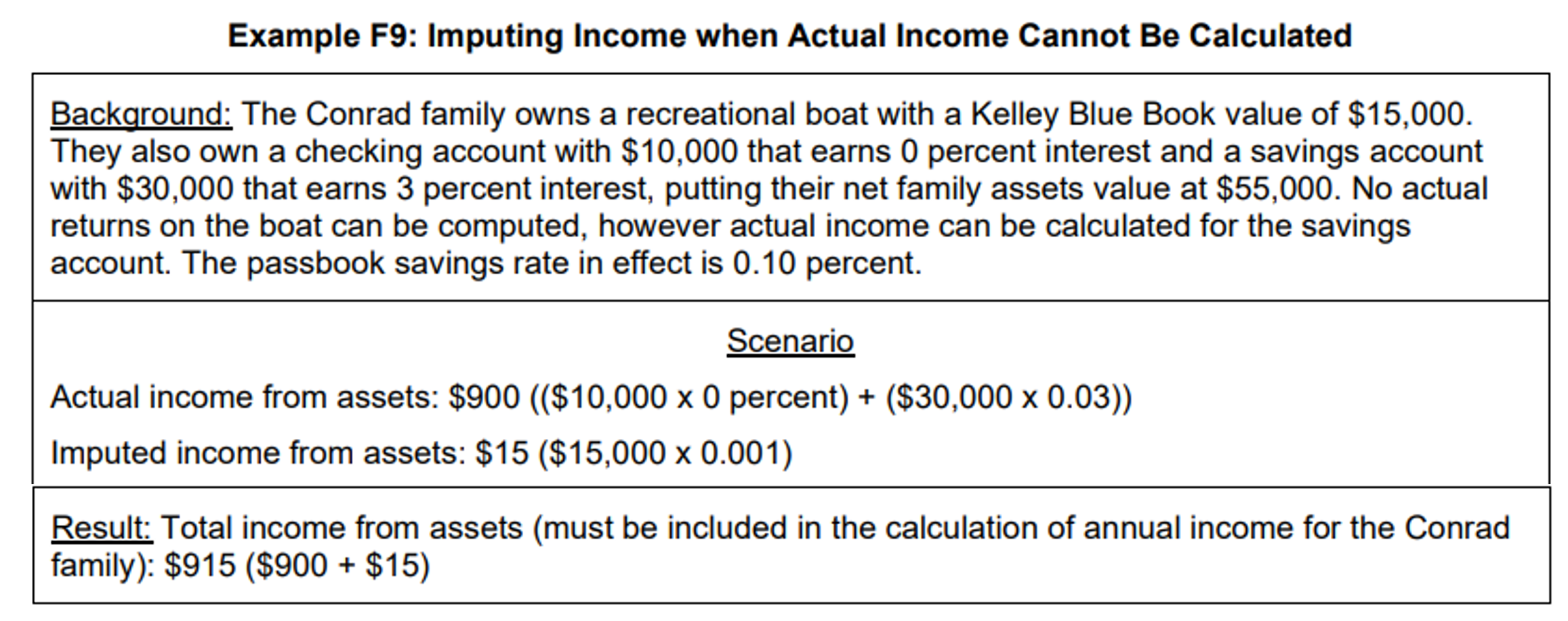

Summary Note | Imputed asset income is only calculated if the total of net family assets exceed $50,000 (as adjusted for inflation). When this is the case, income is imputed only on individual assets when income cannot be calculated for the specific asset.

The Details | In the past, income was imputed on assets when the total cash value of all assets exceeded $5,000. Then the imputed income was calculated based on the total of all assets. The greater of that total imputed income amount or total actual income would be used. According to the new Implementation Notice, F.6.b., HUD says that "imputed income from assets is no longer determined based on the greater of actual or imputed income from the assets. Instead, imputed asset income must be calculated for specific assets when three conditions are met:

- The value of net family assets exceeds $50,000 (as adjusted for inflation);

- The specific asset is included in net family assets; and

- Actual asset income cannot be calculated for the specific asset."

"If the actual income from assets can be computed for some assets but not all assets, then PHAs/MFH Owners must add up the actual income from the assets, where actual income can be calculated, then calculate the imputed income for the assets where actual income could not be calculated. After the PHA/MFH owner has calculated both the actual income and imputed income, the housing provider must combine both amounts to account for income on net family assets with a combined value of over $50,000."

"When the family’s net family assets do not exceed $50,000 (as adjusted for inflation), imputed income is not calculated. Imputed asset income is never calculated on assets that are excluded from net family assets. When actual income for an asset — which can equal $0 — can be calculated, imputed income is not calculated for that asset."

"PHAs/MFH Owners should not conflate an asset with an actual return of $0 ... with an asset for which an actual return cannot be computed, such as could be the case for some non-financial assets that are items of non-necessary personal property. If the asset is a financial asset and there is no income generated (for example, a bank account with a 0 percent interest rate or a stock that does not issue cash dividends), then the asset generates zero actual asset income, and imputed income is not calculated. When a stock issues dividends in some years but not others (e.g., due to market performance), the dividend is counted as the actual return when it is issued, and when no dividend is issued, the actual return is $0. When the stock never issues dividends, the actual return is consistently $0."

Excerpts from HOTMA Implementation Notice | Example F9 and Chart F1

Check out our new upcoming HOTMA training in easily digestible weekly installments!

Sign up to get more information as soon as it is available HERE or click on the image below!

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.