Article | HOTMA Highlights | Personal Property

Oct 11, 2023

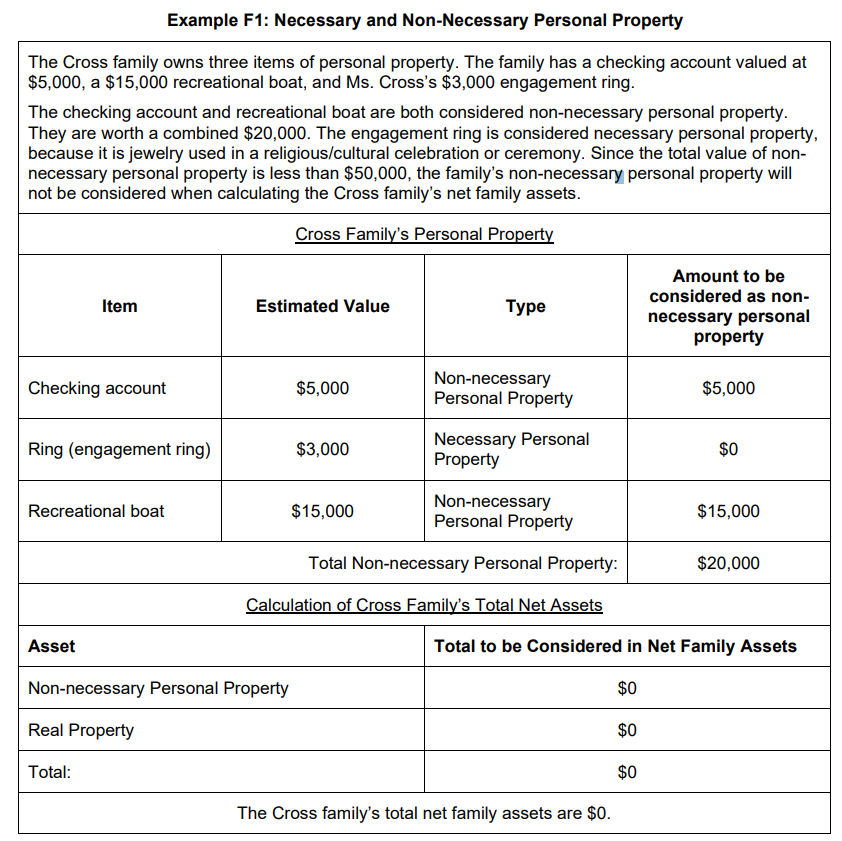

Summary Note | HOTMA breaks personal property into two categories: 1) necessary personal property, which is totally excluded as an asset. Also, 2) non-necessary personal property, which is excluded if total non-necessary personal property does not exceed a $50,000 threshold (as adjusted each year for inflation). If personal property exceeds the threshold, it is counted as an asset. In either case, any actual income is counted that comes from the personal property.

The Details | The HOTMA Implementation Notice discusses two main categories of assets: personal property and real property (HOTMA Implementation Notice F.4.c). This article will discuss personal property. In the past, personal property was excluded as an asset, unless it was being held as an investment. HOTMA addresses personal property in a completely new way. It divides it up into necessary and non-necessary types, with each being handled differently. It also expands the category of non-necessary personal property to include every asset that is not real property or is otherwise excluded.

Necessary personal property is totally excluded. According to the Implementation Notice, 4.F.c, this includes "items essential to the family for the maintenance use, and occupancy of the premises as a home; or they are necessary for employment, education, or health and wellness. Necessary personal property includes more than merely items that are indispensable to the bare existence of the family. It may include personal effects (such as items that are ordinarily worn or utilized by the individual), items that are convenient or useful to a reasonable existence, and items that support and facilitate daily life within the family’s home. Necessary personal property also includes items that assist a household member with a disability, including any items related to disability-related needs, or that may be required for a reasonable accommodation for a person with a disability. Necessary personal property does not include bank accounts, other financial investments, or luxury items...Determining what is a necessary item of personal property is a highly fact-specific determination, and therefore it is incumbent on PHAs/MFH Owners to gather enough facts to qualify whether an asset is necessary or non-necessary personal property."

Items of personal property that do not qualify as necessary personal property will be classified as non-necessary personal property. Non-necessary personal property is excluded if total non-necessary personal property does not exceed $50,000 (as adjusted each year for inflation). If total non-necessary personal property exceeds the threshold, the items of property are counted as assets. In either case, any income earned by the assets is counted. A final implication of exceeding the $50,000 threshold is that if any item of personal property has income that is difficult or impossible to determine, that asset will have asset income imputed at the current passbook savings rate.

Excerpts from the HOTMA Implementation Notice | Table F1 and Example F1

Note: this list includes examples. it is not all-inclusive.

Check out our new upcoming HOTMA training in easily digestible weekly installments!

Sign up to get more information as soon as it is available HERE or click on the image below!

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.