Article | "The Real Deal" - When Residents Own Real Estate | Part 2 - Verification

Aug 02, 2023

Series Outline

The main reason that real estate often seems intimidating is that it usually takes several documents to verify the real estate value and any income. This article will explore the verification needed to establish what we need for resident/applicant-owned real estate.

Working with a Real Estate Broker

The easiest one-page option to establish a property's value is to secure a third-party verification form completed by a real estate professional that provides all the necessary information.

- If a property is for sale, among the seller's agreement paperwork should be a form or forms completed by the selling real estate professional that provides what is needed to establish the market value and costs to sell. This is often referred to as a "Seller Net Sheet." From this, an owner/agent should be able to establish the market and cash values.

- If a property is not for sale, a broker may still be able to research comparable properties on the market and provide the needed estimates. Some owners/agents have developed relationships with brokers for this purpose. Realistically, however, most brokers are not willing to do this work if they don't have the prospect of being the agent in a sale. This makes a broker-completed form the least common form of real estate verification.

If No Broker is Involved

Because broker verification usually is not available for properties that are not for sale, documents supplied by households generally are required to provide the needed information. Below is a breakdown of possible documents collected, and the information these documents supply.

Market Value

The market value is the amount that another person would pay to acquire an asset under current market conditions.

- Real estate value estimator websites (Zillow, or similar). These may provide an estimate of market value, based on comparable recent sales in the area. These estimates can be printed out and placed in household files. Although Zillow in particular has developed a solid reputation, the accuracy of the types of websites can be debated, and it is important to check with your compliance monitor to ensure that they will accept these to use for market values.

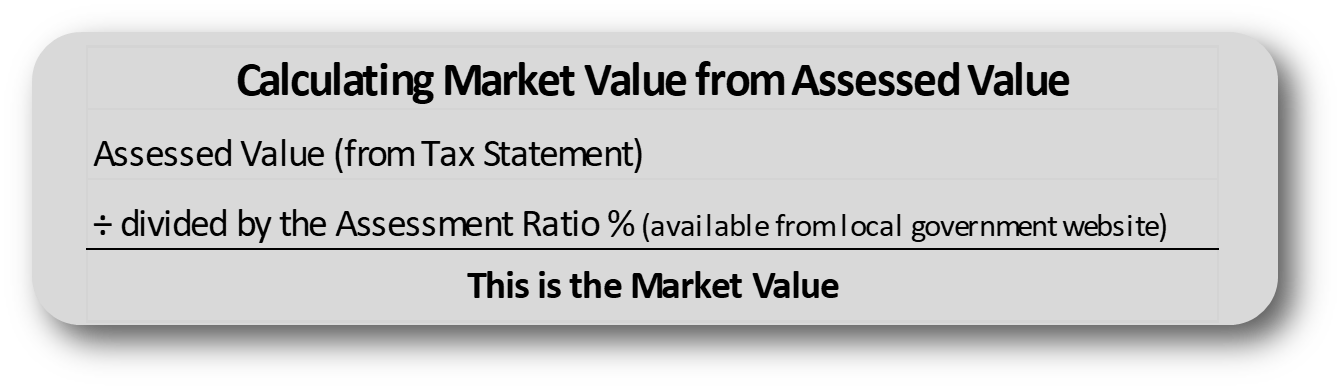

- A tax assessment statement. This establishes the assessed value of the property for taxation purposes. Households will generally receive these statements annually at a set time from the local government. Alternatively, assessed values are available from the local assessor's office - often online. Assessed values, however, do NOT represent full market value. They are generally a percentage of market value (called the "assessment ratio"). Some assessment statements include the market value, which then can be directly used in the file calculations. If the market value is not explicitly stated, however, market value can be calculated if the assessment ratio is also supplied on the statement. If not, then the local assessor's office may need to be contacted to document the ratio. Below is how the assessed value and assessment ratio are used to calculate market value.

Equity and Cash Value

The cash value is the amount another person would pay to acquire an asset (the market value) less the cost to turn the asset into cash. Once market value is established, as above, then estimates of expenses to convert need to be documented. Below are major deductions allowable.

- Mortgage statement. Any mortgage or other lien against the real estate is subtracted from market value to establish the equity in the property. A mortgage statement providing the outstanding principal balance can be used to establish this amount. Note that this document may also be needed if the household is renting the property to establish deductable interest payments (see below).

- Estimate of costs to sell (broker and legal fees). This is a bit trickier if a broker is not involved. This is because broker's fees, for instance, are negotiable and may vary from transaction to transaction and in different areas. Below is a couple of approaches that may work.

- An interview with a local real estate broker may yield at least a range of percentages common in the area where the real estate is located, even if the broker will not provide full information (as discussed above). Documenting this conversation may provide a basis for a reasonable estimate.

- The compliance monitors for a program may provide an estimate that can be used. For real estate broker and legal fees, 10% is believed to be a good estimate by several LIHTC state HFAs and HOME participating jurisdictions, for instance. This is 6-7% for real estate broker fees and 1-2% for legal fees.

Rental Income

If a household is renting real estate out, income is calculated per IRS net income rules. This means that recent tax forms submitted with the owner of the rental property's tax return may provide information on net income. However, not all households file taxes or perhaps taxes have not been due since the rental income became. Below discusses both possibilities.

- When taxes have been filed

- Schedule E. Net income is documented for most real estate rental property on Schedule E. On a side note, this form also documents income from royalties, partnerships, S corporations, estates, trusts, REMICs, and other income per tax laws - in case these are part of a household's file.

- Schedule F. If the real estate is a farm that yields farm income, net income should be documented on Schedule F.

- When taxes have not been filed

- Leases. To establish the rental income that the household is receiving, the lease that they have with their tenants will help establish the gross revenue from the property.

- Blank Tax Schedules. In the 8823 Guide for the LIHTC program, the IRS makes a suggestion relating to net income from a business that may be adapted for the other forms of net income we count, including income from real estate and farms. The suggestion is to hand the owner of the business the appropriate tax schedule and have them complete it based on the business's net income so far, and then annualize it. Most compliance monitors will also require that the household provide for the file the receipts and other evidence to support their calculations of income and expenses that they list on the schedule. This is the same paperwork that they will retain to support the numbers on their tax return. The IRS' formula for annualizing the income is:

-

- Mortgage amortization schedule: Mortgage interest is only a factor in our calculations if it offsets rental income. If this applies, then an amortization schedule of loan payments will establish the interest payments over the 12 months following the certification date.

- Mortgage statement: If an amortization schedule is not available, then a mortgage statement will generally show the interest rate paid on the mortgage. If it also provides the start date of the mortgage and the amount of payments (without any escrow for taxes or insurance), a simple amortization schedule can be assembled using any spreadsheet program (like Microsoft Excel). All major spreadsheet programs have templates designed to create amortization schedules. The applicant/resident or the owner/agent may do the schedule based on the basic information available on most mortgage statements.

Next Article: Specific Real Estate-Related Scenarios

The above topic is just one of many to be discussed at this year's Compliance Summit Events.

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.