Article | "The Real Deal" - When Residents Own Real Estate | Part 1 - Overview - Real Estate Value and Income

Jul 05, 2023

Series Outline

In this article series, we will discuss issues relating to real estate owned by applicants/residents of affordable housing. This will include an overview of how real estate is valued and income calculated, then a discussion of how real estate items are verified. Finally, specific real estate-related issues will be discussed.

Overview

Real Estate can be an asset or it may be a business generating income for the household. HUD states that “If the person’s main business is real estate, then count any income as business income...Do not count it both as an asset and business income.” Evidence that a person’s main business is real estate could be that of all of their income sources, the real estate generates the most income, with perhaps multiple properties owned. Generally, most residents likely simply own real estate that they are renting, and the real estate income does not represent their “main business.”

- Real Estate as a “Main Business”

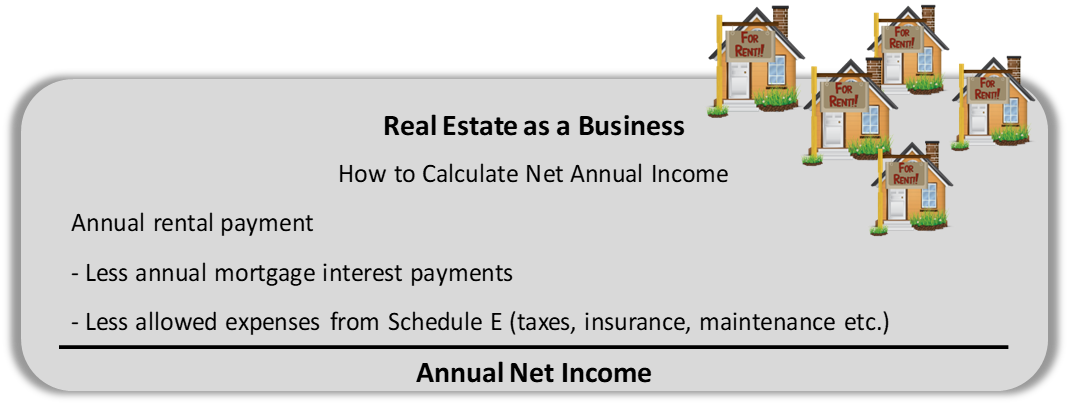

In the rare case of a resident of affordable housing whose main business is real estate, the net income from the real estate is counted (as often documented on tax Schedule E). This means that tax-deductible expenses can be subtracted from the revenue from the business before determining the income that is counted from the business. Real estate is not counted as an asset in these cases.

- Real Estate as an Asset with Possible Asset Income

If real estate is not an applicant’s/resident’s main business, then the property is an asset, and net income, if the property is rented, is considered income from an asset. The HUD Handbook tells us that “if a family owns real estate, it may be necessary to consider the family’s equity in the property as well as the expense to sell the property. To determine the family’s equity, subtract amounts owed on the property from its market value.” So, to determine the asset value for real estate, the owner/agent has to verify the fair market value. Then they must establish any outstanding mortgage balance and the estimated real estate agent and legal costs to sell the property. The outstanding mortgage is subtracted to establish the equity in the property and then the costs to sell the property are subtracted to get the cash value. If the owner of the real estate is also renting the property, the annual rental payments that the owner receives, less any tax-deductible expenses such as mortgage interest payments, taxes, insurance, and maintenance expenses. These expenses are allowable on the tax form Schedule E. Net income from the rental property is thus counted similar to how we count net income for self-employment, although that is found on Schedule C.

More Details:

Market value

- Mortgage amount owed

Equity in the property

Calculate the cash value by subtracting the expense of selling the property:

Equity

- Expense of selling

Cash Value

Example from the HUD Handbook

Juanita Player owns a rental house. The market value is $100,000. She owes $60,000. The cost to dispose of this house would be $8,000. The owner would determine the cash value as follows:

$ 100,000 Market Value

- $ 60,000 Outstanding Mortgage Principle

$ 40,000 Equity

- $ 8,000 Cost of disposing of the asset (real estate commission, and other costs of sale)

$ 32,000 Cash Value

How HOTMA Will Affect Real Estate

How real estate value and income will be calculated will not change with HOTMA in 2024. However, HOTMA does create optional limitations on household assets that owners and PHAs will implement unless they have a specific policy not to. Real estate owned by a household is likely to trigger these limits.

HOTMA allows owners/agents to develop a policy that denies eligibility for occupancy to households with two asset factors:

- They own assets exceeding $100,000, or

- They own real estate that is suitable for occupancy by the household.

These limitations are for HUD housing and do not apply to the HOME, NHTF, or LIHTC programs. If a household loses rental assistance from a PBRA or TBRA program that is subject to these limitations, they will still qualify for HOME or NHTF units as long as they continue to qualify under HOME/NHTF rules.

Note: for HUD properties, there are exceptions to the exclusion based on owning property that is suitable for occupancy, listed below.

- Any property for which the family is receiving assistance under HUD's manufactured homes provisions of public housing rules at 24 CFR 982.620, or under the Homeownership Option in the Housing Choice Voucher program (24 CFR part 982; 237).

- Any property that is jointly owned by a member of the family and at least one non-household member who does not live with the family, if the non-household member resides at the jointly owned property.

- Any person who is a victim of domestic violence, dating violence, sexual assault, or stalking.

- Any family that is offering such property for sale.

A family that owns a property may show it is not “suitable for occupancy” if it:

- Does not meet the disability-related needs of all members of the family.

Examples: Physical needs, proximity to transit, need for additional bedrooms or space, etc.

- Is not sufficient for the size of the family.

- Is located so as to be a hardship for the family.

Example: the location would be a hardship for the family’s commute to work or school.

- Is unsafe because of physical condition, unless issues can be “easily remedied.”

- Cannot be a residence per local or state laws.

Example: a storefront zoned for commercial use only.

Answers: She likely meets several exceptions, including that 1] the home is jointly owned with a non-household member, 2] that she is a victim of violence, 3] the home is not sufficient for the size of the family, and 4] it is located so as to be a hardship for the family.

Next Article: Verification and Real Estate

The above topic is just one of many to be discussed at this year's Compliance Summit Events.

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.