Article | One "HOT" Topic - HOTMA | Part 3 | Assets Redefined

Apr 12, 2023

This is the third in a multi-part series discussing the new HUD HOTMA Final Rule.

Note: FAQs 3 - 6 were covered in the second article.

FAQ 7 | Other than the asset restrictions discussed in the last article, have rules relating to household assets changed?

Answer | Yes, the asset rules have been reformed by HOTMA in § 5.603. These will affect all programs that determine income in a manner consistent with HUD, such as the LIHTC and Rural Development programs.

According to HOTMA, "net family assets" are defined as "the net cash value of all assets owned by the family, after deducting reasonable costs that would be incurred in disposing of real property, savings, stocks, bonds, and other forms of capital investment."

Disposed of assets. In determining net family assets, PHAs or owners, as applicable, must include the value of any business or family assets disposed of by an applicant or tenant for less than fair market value (including a disposition in trust, but not in a foreclosure or bankruptcy sale) during the two years preceding the date of application for the program or reexamination, as applicable, in excess of the consideration received therefor. In the case of a disposition as part of a separation or divorce settlement, the disposition will not be considered to be for less than fair market value if the applicant or tenant receives consideration not measurable in dollar terms. Negative equity in real property or other investments does not prohibit the owner from selling the property or other investments, so negative equity alone would not justify excluding the property or other investments from family assets."

This is very similar to the former rules, but HOTMA's definition of assets soon diverges from the old rules when we examine the exclusions.

FAQ 8 | So, what assets are excluded?

Answer | Excluded from the calculation of net family assets are:

- The value of necessary items of personal property.

- The combined value of all non-necessary items of personal property if the combined

total value does not exceed $50,000 (which amount will be adjusted by HUD in accordance with the Consumer Price Index for Urban Wage Earners and Clerical Workers). - The value of any account under a retirement plan recognized as such by the Internal

Revenue Service, including individual retirement arrangements (IRAs), employer retirement plans, and retirement plans for self-employed individuals. - The value of real property that the family does not have the effective legal authority

to sell in the jurisdiction in which the property is located. - Any amounts recovered in any civil action or settlement based on a claim of

malpractice, negligence, or other breach of duty owed to a family member arising out of law, that resulted in a family member being a person with a disability. - The value of any Coverdell education savings account under section 530 of the

Internal Revenue Code of 1986, the value of any qualified tuition program under section 529 of such Code, the value of any Achieving a Better Life Experience (ABLE) account authorized under Section 529A of such Code, and the value of any “baby bond” account created, authorized, or funded by Federal, State, or local government. - Interests in Indian trust land.

- Equity in a manufactured home where the family receives assistance under 24 CFR

part 982. This is a public housing rule. - Equity in property under the Homeownership Option for which a family receives

assistance under 24 CFR part 982. This is a public housing rule. - Family Self-Sufficiency Accounts.

- Federal tax refunds or refundable tax credits for a period of 12 months after receipt

by the family.

In cases where a trust fund has been established and the trust is not revocable by, or

under the control of, any member of the family or household, the trust fund is not a family asset and the value of the trust is not included in the calculation of net family assets, so long as the fund continues to be held in a trust that is not revocable by, or under the control of, any member of the family or household.

Notice that #7 is the only one that is exactly the same as before. Another important adjustment is that retirement accounts will be excluded. How to handle retirement accounts has been the subject of continual revisions of HUD guidance. It is unclear how many of the former exceptions will become part of Exceptions #1 and #2.

FAQ 9 | I see that "necessary" items of personal property are excluded and "non-necessary" items of are excluded up to $50,000 in the first two exceptions. What is the difference?

Answer | We do not know. The Rule indicates that HUD will provide further guidance on this point.

FAQ 10 | Have the imputed asset rules changed?

Answer | Yes. Under HOTMA, when the value of net family non-necessary assets exceeds $50,000 (in other words, the assets must then be counted, per #2) and the actual returns from a given asset cannot be calculated, imputed returns are calculated on the asset based on the current passbook savings rate. Notice that imputed income is not calculated on the cash value of all assets (as was true formerly), just individual assets for which other income is not calculable.

FAQ 11 | If I do not need to impute asset income when assets exceed $50,000, do I have to count actual income?

Answer | Yes. The actual income from ALL assets that can have actual income calculated must still be counted, even if assets do not exceed $50,000 and are not counted in net family assets.

FAQ 12 | Do these rules apply to LIHTC, HOME, the National HTF, and other programs that use HUD's income definition?

Answer | Yes. See article one in this series for an applicability chart.

FAQ 13 | I have heard that assets can be self-certified if they exceed $50,000. Is this true?

Answer | For a family with net family assets equal to or less than $50,000 an owner may accept a household's self-declaration for purposes of recertifications. This is true except that the owner must obtain third-party verification of all family assets every 3 years.

FAQ 14 | Does this verification allowance apply to LIHTC and other programs?

Answer | Not unless a state LIHTC Agency specifically applies it. The LIHTC program has its own asset verification standards under Treas. Reg. 1.42-5 and Rev. Proc. 94-65 and the IRS would have to issue guidance to adjust that if a state Agency does not. Whether the current "$5,000 asset" self-certification allowance will be expanded to $50,000 federally remains to be seen. Some states have indicated they may apply this as they feel it will be part of 'determining income in a manner consistent with Section 8' as required by LIHTC law and regulation.

Up next: Income definition changes.

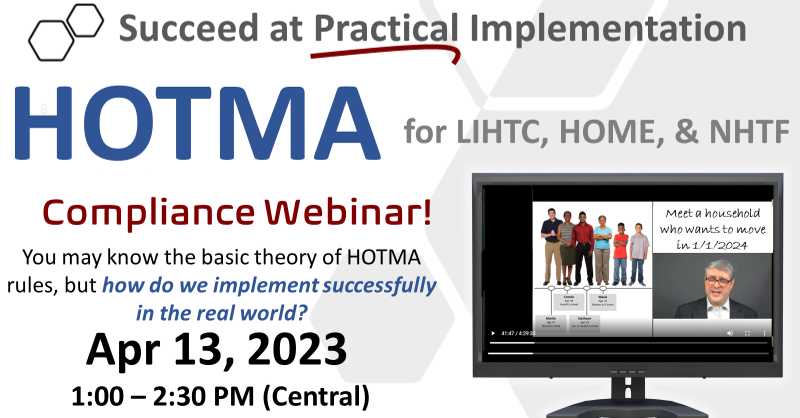

Coming soon! Click on the below image for information and to register

There is a very good chance that the topic of this post is covered in an online on-demand course at Costello University.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.